The question on everyone’s mind is how long foreign investors will continue to support US Treasury debt, which has now risen to $34.75 trillion and is expected to reach $35 trillion in the coming months. All of these securities are owned by someone, and some are owned by foreign entities.

So far, demand for these Treasuries from all directions has been tremendous, as documented by the yield on the 10-year note, which is expected to exceed 5%, given the inflation situation (3.4% for core CPI with a lot of uncertainty) and the . of short-term returns (5.5%). But the yield on the 10-year bond is only 4.2%. Let’s take a look at all this with help wolfstreet.

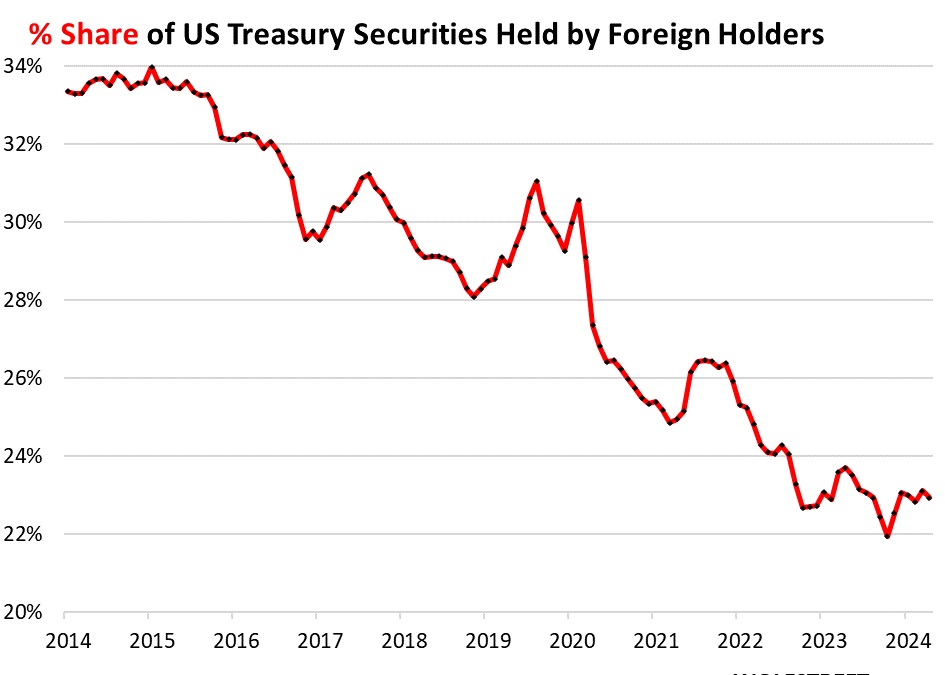

Share of foreign equity.

Foreign investors have continued to increase their holdings of Treasury securities over the years, but US debt has grown much faster, relative to their purchases, and so the share of debt held by foreign entities has declined for many years. In the period 2014-2016, foreign investors acquired more than 33% of the debt. Now their share has decreased to 22.9%.

Percentage of US debt in foreign hands

In other words, US debt financing has become less dependent on foreign holders – and, as we will soon see, less dependent on China and Japan.

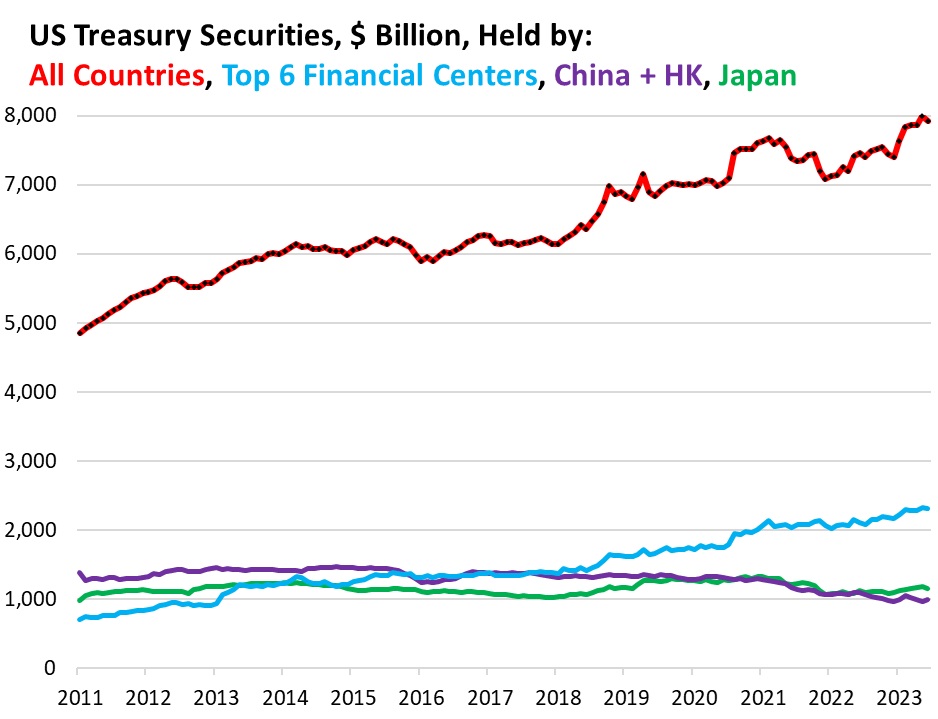

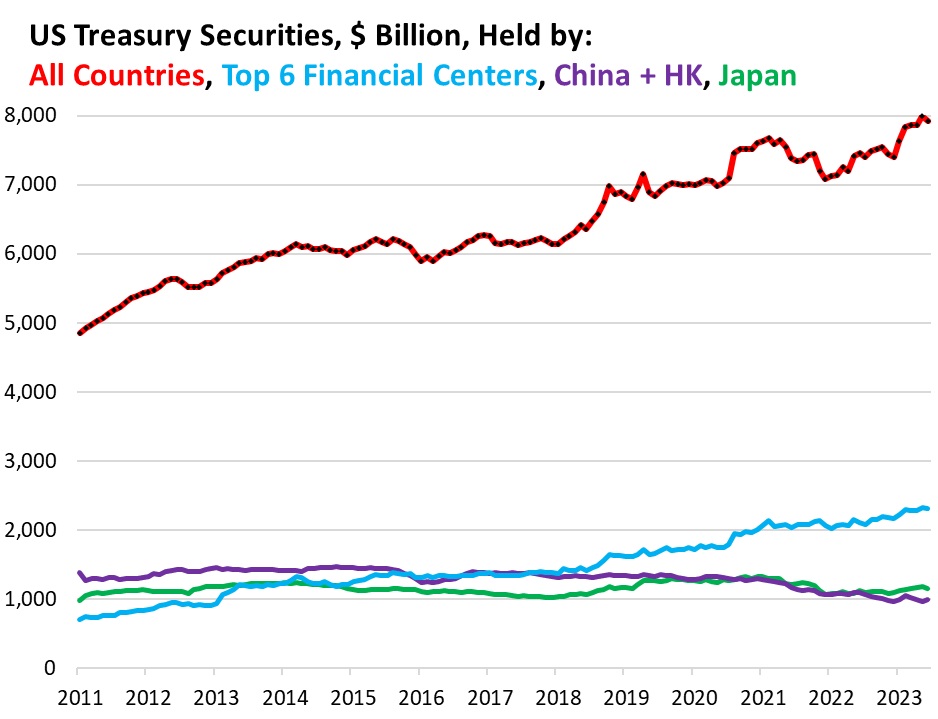

In dollar terms, Treasury debt held by foreign entities rose to an all-time high in March, and fell slightly in April to $7.92 trillion, an increase of $468 billion from the previous year, or 6.3%, according to Ministry of Foreign Affairs data. Treasury on Tuesday (red line in the chart below).

Compare major buyers of US debt

- The six major financial centers (London, Belgium, Luxembourg, Switzerland, Cayman Islands, Ireland): $2.3 trillion (blue), +9.2% YoY, despite a decline in April from an all-time high in March.

- Japan is the largest creditor to the United States: $1.15 trillion (green), +2.2% compared to last year. Over the past 12 years, Japan’s holdings have remained in the same range of $1 trillion to $1.3 trillion, reaching the lower end of the range in 2011 and 2018.

- China and Hong Kong combined: -9.1% YoY, to $992 billion (purple), up slightly in April from the lowest level in recent years.

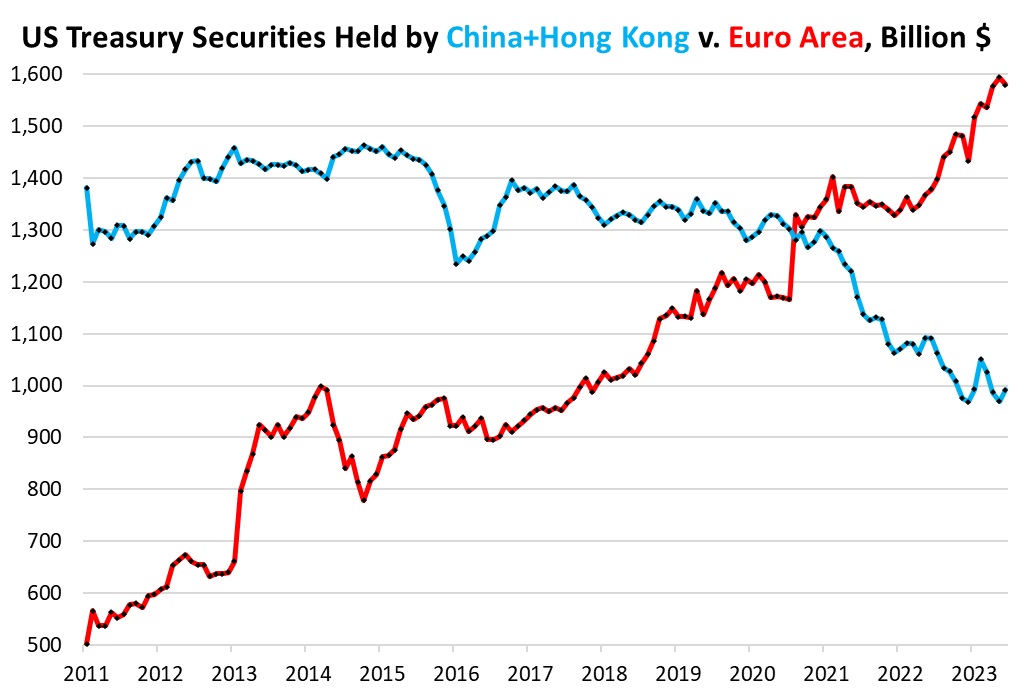

China + Hong Kong vs Eurozone

China and Hong Kong reduced their combined holdings from more than $1.4 trillion in the period 2012-2017 to $992 billion (in blue). During the capital flight panic of 2016, China’s holdings of Treasury bonds fell sharply in an attempt to support the renminbi. Its holdings increased again, but they never returned to their previous level, and their holdings have declined since then.

Eurozone countries were buying US Treasury bonds at a very rapid pace, expanding their holdings from $500 billion in 2011 to $1,580 billion today (in red), an increase of more than a trillion dollars. On an annual basis, Eurozone holdings increased by $202 billion, or 14.6%!

Top six financial centers – United Kingdom (City of London), Belgium, Luxembourg, Switzerland, Cayman Islands and Ireland: +9.2% YoY to $2.31 trillion, the second highest level ever, just behind March. More than tripled since 2011!

These countries specialize in managing the financial holdings of global companies, individuals and governments. Ireland is the preferred destination for American companies to maintain their profits. So some of their properties are actually owned by US entities.

- United Kingdom: $710 billion

- Luxembourg: $384 billion

- Cayman Islands: $319 billion

- Ireland: $308 billion

- Belgium (home of Euroclear): $312 billion

- Switzerland: $272 billion.

Japan’s holdings: +2.2% YoY, to $1.150 billion, with a decline in April. They rose in a zigzag pattern, starting in late 2022, after falling sharply.

Other foreign holders of Treasury securities:

- Canada: $338 billion, +36.9% compared to the previous year, despite the decline in April! Entries have multiplied by 7 in the last 12 years! Do Canadians like US Treasuries that much?

- Taiwan holdings: $257 billion, +5.3% y/y, just below the record high set in March:

- India’s assets: $234 billion, a decrease of 2.2% compared to the previous year. India has multiplied its holdings by six since 2011:

- Brazil’s assets: $224 billion, a decrease of 2.7% compared to the previous year. In 2023 and 2024, the trend is higher, after falling by about a third from the 2018 peak.

- France’s holdings are part of the eurozone chart above, but it is one of the largest players in the eurozone, along with the eurozone’s financial centres, and much larger than Germany. Its holdings increased and in April reached a new all-time high of $277 billion (compared to Germany, which held only $87 billion).

Will foreigners continue to buy US debt?

Foreign interest will continue to depend on three factors:

- The real profitability guaranteed by the title is now positive;

- The centrality of the dollar in international financial transactions

- The centrality of the United States of America in trade systems, which requires a certain amount of dollars.

These three factors will affect the future ability to absorb dollars.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”