We often talk about digitalization, innovation, and “going green,” but in reality, who wants to finance all these good things for businesses and families?

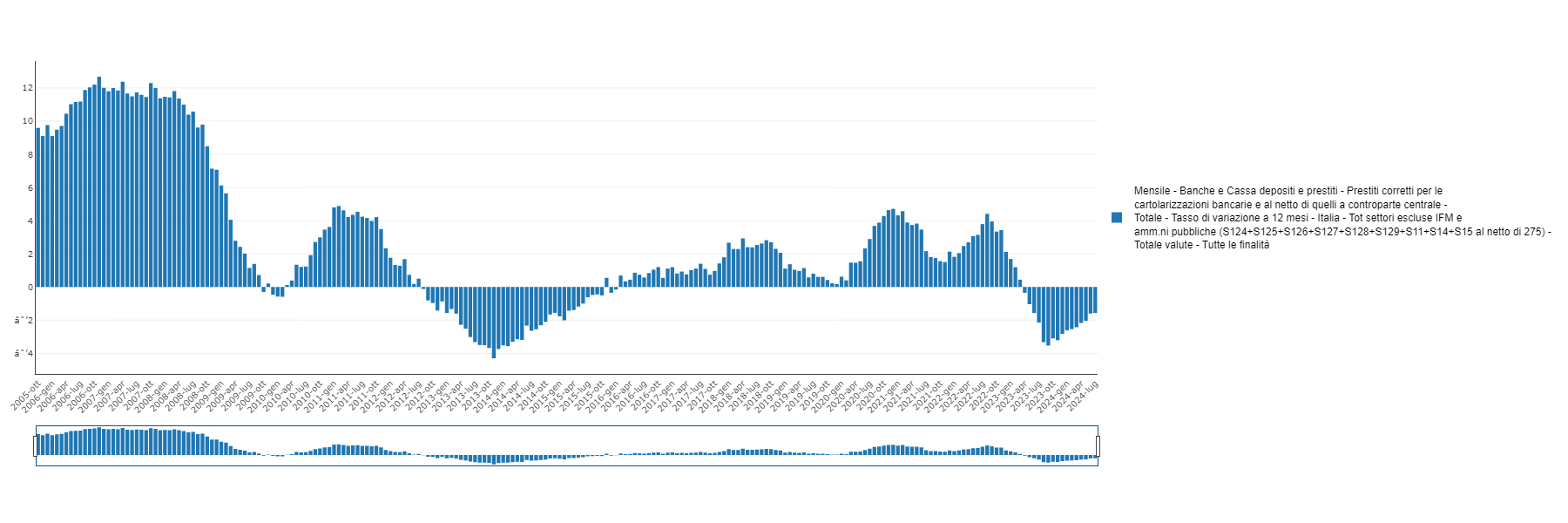

Banks certainly don’t: according to the Bank of Italy’s latest bulletin, and as highlighted by CanaleSovranista, we are in the sixteenth consecutive month of bank credit cuts to businesses and households:

It is clear that this credit crunch is happening with the approval of the Bank of Italy and the European Central Bank. The positive side, if we are to find it, is that there is no risk of a boom in non-performing loans, as we see in France and Germany: companies and households do not get credit, or get very little, so there is much less chance of causing losses to the bank.

The downside is that, in this particular credit crisis, it is almost a miracle that Italy is still enjoying minimal economic growth in the face of this continuing decline in the resources available to businesses.

We often talk about “mobilizing the Italians’ savings.” But there is no point in transferring them when they end up in the banking system, which does not put them back into circulation in the form of financing.

“Internet trailblazer. Travelaholic. Passionate social media evangelist. Tv advocate.”